Abstract

City corporations in Bangladesh

Key words: City

Corporation, Budget, Revenue, Tax,

Rates, Grants, Municipality, Finance, Administration.

1.1 Introduction

As

cities growth and decentralization becomes more common, local governments are

assuming greater responsibility for providing and financing effective public

services. In East Asia (excluding Japan Bangladesh Bangladesh

City Corporations are one of the tiers of urban local

government in Bangladesh

The City

Corporation of Bangladesh

1.2 Rationale of the study

The city corporations of Bangladesh Khulna Bangladesh

1.3 Scope and

limitation of the study

The present study mostly centered on the problems and

prospects of municipal income of Khulna City Corporation. More specifically the

study discusses about the revenue sources and administrative management of the city

corporation.

In the present study, the following are the limitations:

·

Detailed data are not

available in a systematic manner

·

Limited time

2 Municipal budgeting and financial

management

2.1 Introduction

Budgeting is a

key component of a decentralized system of sub national finances. Without

adequate budgetary autonomy and accountability, there is no real possibility of

attaining the efficiency gains associated with fiscal decentralization.

Budgetary autonomy means that sub national governments have discretion

regarding the level of services they deliver, their mix , as well as the

ability to decide how to produce public

services, in particular what inputs to hire and how much to pay for them.

Budget institutions and processes are important for decentralized system of

intergovernmental finances because they provide the mechanism to translate

taxpayer preferences into spending decisions and because they help maintain sub

national government officials accountability to tax payers.

2.2 Budget process and issues

In Bangladesh Bangladesh

2.3 Budget preparation

Budget

preparation typically takes anywhere between two to six weeks when

international practice shows that adequate budget preparation should take at

least several months. The budget proposal is formulated through the expenditure request of the

various budget units, following the budget calendar, which usually begins early

to mid-April and is concluded by late May. Absent from this process are the

budget preparation guidelines and understanding that accompany good budgeting

practices, policy service objectives, and accurate and achievable estimates of

revenues and expenditures. Thus the revenue and expenditure estimates are not

conducive to good budgeting practices and the budgeting process itself appears

to be merely an academic exercise. In fact budget preparation appears to

represent little more than an incremental adjustment to the previous year’s

budget in very general line-item descriptions and with disregard of the

deference between what has been budgeted and what has been executed. Unlike

modern budget practices, the proposed municipal budgets are not based on an

analysis of service level needs or planned policy objectives.

The scope of the

budget preparation process at the municipal level must be expanded to allow

greater technical and public comment on the content on the proposed expenditure

plans. The fact that the budget preparation process requires only 2-6 weeks

dooms the process to be little more than a perfunctory and essentially

meaningless effort. A structured and formal effort should begin immediately to

draft new budget forms which require more detailed information on the services,

activities, and projects for which expenditures are being recommended. To

prepare such budget forms in a manner that accurately reflect the proposed

expenditure plan, the municipal political and civic leaders must also embark on

the strategic planning activity that results in identifiable and measurable

objectives with specific target dates. The budget plans should be explained to

tax payers in open council meetings and publicized in the press.

2.4 Budget approval process

The budget

approval process starts with reviews and modifications of the draft budget by

the City Corporation authority to submission to LGD for more modifications and

adjustments in specific line items (if it appears that expenditure plans are

unrealistic relative to likely revenue receipts) prior to final approval. This

process of review at the Ministry level appears to be particularly meaningless,

since evidence year after year shows that expenditure and revenue projections

are grossly unrealistic, and GOB has not done anything to address this issue.

At this point in the budget process, LGD also indicates to the municipality the

amount of local government grants to be received and development projects to be

funded. Typically the approved budget is returned to the City Corporation by

mid-August even though the fiscal year begins July 1. An important issue is the

disjunction between the municipal budget approval process and the governments

own budgeting process. The fact that the municipal budgets are approved after

the government’s own budgeting process is completed, raises questions as to

whether municipal needs are considered as input into the grant resource

allocation by GOB.

The budgeting

and funding practices of the national government bear a substantial

responsibility for the generally substandard budgeting and fiscal management

policies and practices at the municipal level. To expect municipal officials to

prepare budgets without any prior indication of the level of block grant

funding from the GOB is irrational so long as the block grants remain such a

significant proportion of the City Corporation.

The timing of

the budgeting process therefore needs to be synchronized with the central

government budgeting process to allow need assessment, prioritization of

investments and enable final municipal proposed budgets to be used as input in

the central budget resource allocation exercise. The municipal budgeting

exercise should therefore start earlier. In addition, the fiscal timing of the

block grant process should be structured to provide fiscal incentives to

improve fiscal management at the municipal level. To achieve reform objectives,

the GOB should establish budget targets for the block grant category and

provide appropriate fiscal guidelines to the City Corporation by April 1 each

year for the succeeding fiscal year. Simultaneously, the criteria to be used in

the allocation of these funds should be published and implemented as announced.

2.5 Budget execution and management

The successful

execution and management of the budget requires the establishment of policies,

procedures, and efforts to assure the prompt and timely collection of revenues

and for each management purposes, the expeditious investment of those revenues.

Similarly the rate expenditures should not only be monitored in terms of actual

levels, but should be evaluated relative to previously approved and a need upon

budget expenditure plan. In this phase of the budgeting process the policies

and practice of Bangladesh

Under normal

circumstances, the third quarter budget review could provide an excellent basis

for developing a more continuous and meaningful expenditure management process.

A quarterly formal review of revenue receipts and expenditures could provide

the transition to the adoption of monthly monitoring of expenditures and

revenues and a more effective budget execution process. Another important issue

in budget execution is the lack of decision powers of officials in charge of implementing

municipal functions. Officials in charge of different spending units should be

granted flexibility on management decisions within their assigned budgets. To

guarantee compliance with the budget mandates, spending units should be

required to seek permission from the chief executive officer before funds are

re-allocated across budget categories.

2.6 Strengthening municipal financial management

The budget and

financial management process should seek to achieve two principal public policy

goals.

(a)

Reflect in discrete and observable ways the purposes

for which public sources will expended, by being more open(and more responsive

to its citizens), and more descriptive of the services to be offered, by whom

they will be provided, and to whom they will be provided.

(b)

Provide a means of measuring both political and fiscal

administrative accountability. The most important role of sub-national

governments is to decide what expenditures best satisfy the needs and service

requirements of its citizens. The successful achievement of this roll is both

politically desirable and economically efficient as well.

3 Municipal incomes

3.1 Introduction

Municipal income

is very much depending upon local tax and central Government allocation in Bangladesh

3.2 Municipal income

The main revenue

source of City Corporation is holding tax (land, conservancy, lighting, and

water supply). Now tax revenue, Government grants etc. The main source of City

Corporation revenue can be divided into three groups:

The Third source

is very low is proportion to the total revenue of the City Corporation. Government

grant includes all types of supportive assistant from the own source revenue

includes taxes, rates, fines, tolls and profits from own property. Own revenue

has always constituted the major portion of income in the City Corporation.

3.2.1

Internally

raised revenue

Internal revenue

can be broadly classified in three categories. They are:

- Land or Property Based Revenue

- Activity based or Benefit Based Revenue

- Income from City Corporation own property

This includes

tax on house, rates of electricity, water and conservancy and urban immovable

property transfer tax. While the first three are purely local lives, the fourth

one is a tax shard with the government.

3.2.1.2 Activity based or benefit based revenue

These include taxes

on profession, trades and callings tax on application of erection and re-erection

of buildings, taxes on advertisement, amusement vehicles fees for markets and

licenses and tolls on ferries, bus stand and sand deposits.

3.2.1.3 Income from City Corporation own

property

This includes

Paurashava own property income for shops, land, building, markets, auditorium,

community centre, ponds and boarding houses.

3.2.2

Government Grant

Government

grants are all types of supportive assistance from the center. The grants are

wanted mainly for paying a portion of the salaries and compensations of local

employees, honorarium of elected representatives’, maintenance of

infrastructures and development of roads, culverts, drains and canals. The

Government grants are of the following:

- Urban normal grant

- Octroi compensation grant

- Urban works program grant

- Special development grant

3.2.2.1 Urban normal grant

These include

special salary grants compensatory grants for special purposes like mosquito

eradication, education programs, medicine and injections. The basis for normal

or recurrent grant is the need for additional resources for salaries of staff

in the City Corporation and the traditional quantum of aid that had been

following.

3.2.2.2 Octroi compensation grant

Octroi

compensation grant was started from the fiscal year 1981-1982 as a replacement

to the City Corporation lost income from octroi tax, which was suspended by a

central decision at the recommendation of the taxation inquiry commission.

3.2.2.3 Urban works program grant

Urban works

program (UWP) grants have been the primary development grant for the urban

local bodies in Bangladesh

3.2.2.4 Special development grant

In Bangladesh

3.2.3 Loans and advances

Loans and

advances is the third source which is very small in proportion in context of

total revenue of the City Corporations in Bangladesh

Revenue from

different sources of City Corporation is followings:

Table01: Revenue

from different sources in City Corporation

|

Internal sources

|

Government grants

|

Loans and advances

|

|

Holding tax,

property tax,

tax on erection of buildings,

profession tax,

tax on establishment,

tax on vehicles,

fees for markets,

other taxes and tolls,

own property income,

other income

|

Normal grant,

Octroi compensation,

Works program,

Development assistance

|

Government loan,

Foreign loan

|

Source: Municipal

finance in Bangladesh

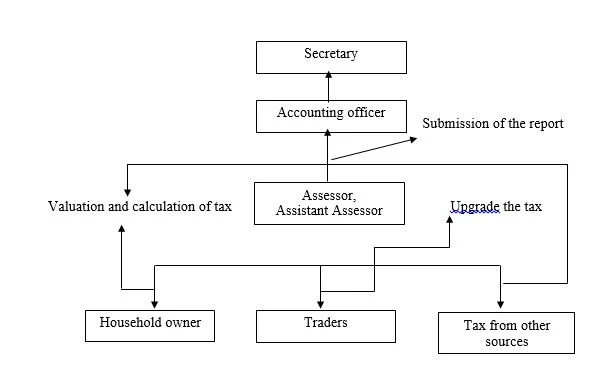

Revenue collection process

diagram of KCC is shown in the next page in figure no. 01.

4.0 Revenue Collection Process

Figure01: Revenue

Collection Process diagram of KCC.

5.0 General Information about KCC

Table02: General information about KCC

|

Worker

|

1287

|

|

Ward

|

31

|

|

Population

|

15,000,00

|

|

Area

|

45.65 sqkm

|

|

Holding number

|

40640

|

|

Property

|

163.94 acre

|

|

Slam

|

55

|

|

Super market

|

16

|

|

Community centre

|

26

|

|

Cemetery

|

7

|

|

Park

|

9

|

|

Child park

|

2

|

|

Bazar

|

26

|

|

Public toilet

|

10

|

|

Shasan

|

4

|

|

Slaughters house

|

3

|

|

Health centre

|

3

|

|

Urban primary health care centre

|

27

|

|

Maternity centre

|

2

|

Source: KCC, 2003.

6.0 Municipal income

of Khulna City Corporation

The income of KCC

is basically two types as well as other city corporations. The contribution in

yearly expenditure the income from external sources is several times higher

than income from internal sources. The contribution of internal and external

sources of income of KCC is shown in the table below.

Table03: Revenue

from different sources in KCC.

|

Year

|

Internal source

|

Percent

|

External source(Govt.)

|

Percent

|

|

2000-01

|

32,10,74,829.00

|

12.38

|

227,71,33,892.00

|

87.62

|

|

2001-02

|

35,11,42,128.00

|

13.01

|

234,72,39,000.00

|

86.99

|

|

2002-03

|

42,97,35,805.00

|

15.02

|

243,10,54,000.00

|

84.98

|

|

2003-04

|

36,17,17,325.00

|

13.61

|

229,51,20,000.00

|

86.39

|

|

2004-05

|

39,19,90,000.00

|

13.80

|

245,17,00,000.00

|

86.20

|

Source:

Annual Budget, KCC.

From the above

table we can find that in total income of KCC in year 2000-2001 the

contribution of internal source is 12.38% where contribution of external source

is 87.62%. In year 2001-2002 the income from internal source is 13.01% and income

from external source is 86.99%. Income from internal and external source is

15.02% and 84.98% in year 2002-2003. Contribution to total income from internal

and external source is 13.61% and 86.39% in fiscal year 2003-2004 and

contribution of internal and external source is 13.80% and 86.20% in year

2004-2005.

Table04: Total

income and expenditure of KCC.

|

Year

|

Total income (tk)

|

Total Expenditure(tk)

|

|

2000-01

|

259,82,08,721.00

|

257,98,06,743.00

|

|

2001-02

|

269,83,81,128.00

|

269,83,81,128.00

|

|

2002-03

|

286,07,89,805.00

|

281,08,76,450.00

|

|

2003-04

|

265,68,37,325.00

|

255,68,37,289.00

|

|

2004-05

|

284,36,90,000.00

|

284,55,16,200.00

|

Source: Annual Budget,

KCC.

The table above

shows the total income and expenditure of five years of KCC. More or less the income and expenditure of

every year is near to same. The total income of fiscal year 2002-2003 is 286,

0789,805.00 which is the highest income within five years and total expenditure

of year 2004-2005 is 284,55,16,200.00 which is the highest expenditure within

five years.

6.1 Organogram of

revenue collection system of KCC

Figure02: Organogram of revenue collection

system of KCC

Working process

diagram of Tax assessment of KCC is shown on next page in figure no.03.

6.2 Working process diagram of Tax assessment of KCC

Table05: Revenue from internal sources of Khulna City

Corporation.

|

Internal Sources

|

Amount of income (in tk)

|

|

Tax

|

10,73,45,000.00

|

|

Rates

|

10,80,00,000.00

|

|

Fees

|

2,79,70,000.00

|

|

Penalty fee

|

1,65,000.00

|

|

Others

|

72,10,000.00

|

|

Govt grant

|

70,00,000.00

|

|

Profit from bank

|

60,00,000.00

|

|

Tender form

|

2,00,00,000.00

|

|

Asphalt plant

|

1,25,00,000.00

|

|

Roller fare

|

20,00,000.00

|

|

Bus/truck terminal

|

10,00,000.00

|

|

Miscellaneous

|

20,00,000.00

|

|

Salary &

advance back

|

15,00000.00

|

|

Water supply

|

8,93,00,000.00

|

|

Total

|

39,19,90,000.00

|

Source: Annual Budget

2004-2005, KCC.

The above table

shows that total income from internal source is 39, 19, 90,000 in fiscal year

2004-2005. the highest income is gain from rates sector which is 10,80,00,000,

next greater income is generated from tax sector which is 10,73,45,000 and next

from water supply and the amount is 8,93,00,000. The lowest income is generated

from penalty charge and the amount is 1, 65,000.

Table06: income from external

sources of Khulna City Corporation.

|

Sources

|

Amount of income (in tk)

|

|

Govt. special grant

|

10,00,00,000.00

|

|

Govt. grant in ADP

|

104,37,00,000.00

|

|

Govt. grant in projects

|

109,20,00,000.00

|

|

Total

|

223,57,00,000.00

|

Source: Annual Budget

2004-2005, KCC.

From the above

table we find that total income from external source in fiscal year 2004-2005

is 223,57,00,000 in which the largest contribution is from govt. grant in

projects and the amount is 109,20,00,000 next contribution from govt. grant in

ADP and the amount is 104,37,00,000 and next contribution is 10,00,00,000 which

is contributed from govt. special grant.

Table07: Revenue

from tax sector of KCC.

|

sources

|

Amount of income (in tk)

|

|

Holding tax

|

8,40,00,000.00

|

|

property transfer tax

|

80,00,000.00

|

|

Registration of premises tax

|

2,00,000.00

|

|

Profession tax

|

97,30,000.00

|

|

Advertisement tax

|

6,50,000.00

|

|

Cinema tax

|

17,50,000.00

|

|

Transport tax

|

2,00,000.00

|

|

Rickshaw, van tax

|

28,00,000.00

|

|

Animal tax

|

15,000.00

|

|

Total

|

10,73,45,000.00

|

Source: Annual Budget

2004-2005, KCC.

The table above

shows that total revenue earned from tax sector in fiscal year 2004-2005

is 10, 73, 45,

000. The maximum contribution is earned

from holding tax and the amount

is 8, 40, 00,

000 and the lowest income is generated from animal tax which is 10,73,45,000.

Table08: Revenue from

fees sector of KCC.

|

Sources

|

Amount of income (in tk)

|

|

Toll from Bazar

|

50,00,000.00

|

|

Super market fare

|

1,10,00,000.00

|

|

slaughters

|

7,00,000.00

|

|

Warrant fees

|

20,000.00

|

|

A.R.V sell

|

50,000.00

|

|

License for rickshaw

|

2,00,000.00

|

|

Fare from Hall and park

|

1,00,000.00

|

|

Road cut & Damerage

|

50,00,000.00

|

|

Fare from zia hall

|

7,00,000.00

|

|

License fees from

contractor

|

27,00,000.00

|

|

Surcharge

|

25,00,000.00

|

|

Total

|

2,79,70,000.00

|

Source: Annual budget

2004-2005, KCC.

From the above

table we can see that total income of fees sector in fiscal year 2004-2005 is

2, 79, 70, 000.

The income generated from market fare is 1, 10, 00, 000 and others contribution

from various sources of fees. The lowest amount of income is only 20,000 which

are generated from warrant fees.

Table09: Revenue from water Department of KCC.

|

Sources

|

Amount of income (in tk)

|

|

Water tax

|

|

|

previous

|

2,88,00,000.00

|

|

current

|

2,92,00,000.00

|

|

Pipe line connection

|

5,00,000.00

|

|

Monthly charge

|

|

|

previous

|

2,00,00,000.00

|

|

current

|

1,00,00,000.00

|

|

Special water supply

|

8,00,000.00

|

|

Total

|

8,93,00,000.00

|

Source: Annual budget

2004-2005, KCC.

The above table

shows that total income from water department as tax from water supply is 8,

93, 00, 000 in fiscal year 2004-2005.

Table10: Tax collection performance of KCC.

|

Year

|

Types

|

Amounts (in tk)

|

Percentage

|

|

2000-2001

|

Collected

|

8,11,24,283.00

|

25.27

|

|

|

Not collected

|

23,99,50,546.00

|

74.73

|

|

2001-2002

|

Collected

|

12,38,04,521.00

|

35.26

|

|

|

Not collected

|

22,73,37,607.00

|

64.74

|

|

2002-2003

|

Collected

|

12,24,80,982.00

|

28.50

|

|

|

Not collected

|

30,72,54,823.00

|

71.50

|

|

2003-2004

|

Collected

|

13,31,76,530.00

|

36.82

|

|

|

Not collected

|

22,85,40,795.00

|

63.18

|

|

2004-2005

|

Collected

|

18,29,90,014.00

|

46.68

|

|

|

Not collected

|

20,89,99,986.00

|

53.32

|

Source: KCC record,

2005.

Thus we can

realize the tax collection performance of KCC is in bad condition. Every year

very few percent of revenue can be collected. Within five years highest revenue

is collected in fiscal year 2004-05 which is 46.68%. In fiscal year 2000-2001,

2001-2002, 2002-2003 and 2003-2004 the revenue collection is 25.27%, 35.26%,

28.50% and 36.82% respectively. The main defaulters of tax payment are

politicians and government itself.

7.0 Problems of

revenue earning process

The paurashava

ordinance states that “City Corporation may with the previous sanction of the

government levy is the prescribed manner, all or any of the taxes, rates, tolls

and fees mentioned in the first schedule.” So by legislation the City

Corporation authority is liable to fix up tax and collect them. Tax collection

depends on the execution of this rule properly. The main problems of tax

collection in Khulna

City

¨

Tax assessment and collection procedure is

backdated and corrupted.

¨

Lack of consciousness of the people

¨

Administrative problems

¨

Influence of local politicians and pressure

groups

¨

Lack of strong database

¨

Lack of personnel

¨

Corruption and irregularities

¨

Other problems

8.1 Conclusion

Municipal

finance is very much important. In context of Khulna City Corporation the

municipality is very much dependent on central government allocation. For self

sufficiency of municipality the reformation of municipality is very much needed.

The expert manpower should be employed in City Corporation. In Division level

there are other government agencies those are responsible for some activities.

There exists parallelism of activities and lack of coordination among them. As

a result municipality can not play the desired role in urban management. So an

intergovernmental coordination is very necessary.

The legal

framework of municipalities should therefore be reviewed right away with the

objectives of consolidating and simplifying the numerous legal provisions

affecting City Corporation. The best strategy for reform is to update and

expand the paurashava ordinance, municipal law, consolidate all the different

legal provisions in regulations and standing orders and apply equally for

paurashava and city corporations with specialized provision where necessary.

The objectives of this law would be to provide a legal framework for

municipalities more self government and operational independence and imposes

more accountability in their performance, including flexibility in alternative

ways to provide municipal services.

8.2 Recommendations

References

Khulna City

Corporation (KCC), Annual Budget

2000-2005, Khulna , Bangladesh

Hossain, M., 1989, Municipal finance in Bangladesh Dhaka .

Hasan, k.,

1997, Bangladesh Dhaka .

Ferdous, S., (1999), Expenditure pattern

of a paurashava: a case study on Kushtia paurashava, BURP thesis, Urban and

rural planning Diacipline, Khulna

University Khulna , Bangladesh

Roy, K.T., (1998), Utilization

of municipal immovable properties: A Study on Bagerhat Paurashava Khulna University Khulna , Bangladesh

World Bank, (1997), Bangladesh Bangladesh Dhaka , Bangladesh

Ahmed, N., (1992), Barisal Paurashava finance, A journal of local Government, Vol.21, No.2, National Institute of Local Government

publication, Dhaka, Bangladesh.

Comments

Post a Comment